Castle Hall is the investment industry's largest dedicated due diligence provider, now in our 15th year of operations.

Castle Hall works with more than 100 clients to conduct institutional quality due diligence across all asset classes.

15 years of success and still counting...

Castle Hall begins serving its client base in January 2007. From the outset, Castle Hall elects to work only with investors, not asset managers, making the firm completely buy side funded. Castle Hall always offers clients robust segregation of duties, separating the governance, risk and compliance due diligence function from the advocacy role of investment decision making. Castle Hall has never managed assets, built portfolios, or sourced and recommended funds.

Conducting due diligence on Lakeshore, Castle Hall finds that the fund's administrator was relying on a daily email of trade data being sent to them by "trades@primebrokers.co.uk". The domain had been set up by the hedge fund's CFO. Investors lost more than $300 million - but thankfully not Castle Hall's client.

In November 2008, Castle Hall publishes a white paper asking whether 2 and 20 is flawed, whether funds need better corporate governance, and questioning why fund offering documents protect the manager more than the investor. 10 years later.....

Castle Hall publishes a white paper analyzing the causes and lessons of hedge fund operational failure, considering more than 300 operational events in the hedge fund industry.

Castle Hall begins operations in Australia to serve the Superannuation industry. Australia's regulatory environment, led by APRA, subsequently makes operational due diligence a requirement for Super funds.

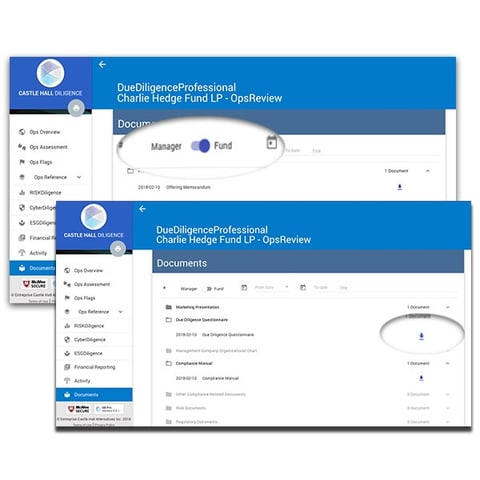

Castle Hall launches the first version of OpsDiligence, the firm's online due diligence platform. The platform is based upon OpsData, which replaces inconsistent, manager generated DDQ formats with a standardized ODD reference manual for every fund in an investor's portfolio.

Castle Hall and SwissAnalytics, based in Zurich, enter into a strategic partnership, which results in a full merger of activities in 2017. SwissAnalytics provides coverage for Castle Hall's European clients and also contributes the firm's risk due diligence methodology, which evolves to become RiskDiligence.

Castle Hall Diligence is proud to announce that the firm has been named the “Best Global Hedge Fund Operational Due Diligence Firm” in the 2014 Alternative investment Awards. Castle Hall subsequently wins the same award, now for five successive years.

Castle Hall Diligence launches Due Diligence University™, a growing ecosystem of educational resources including webinars and white papers.

Exiger and Castle Hall Diligence announce a business partnership to deliver next generation due diligence services to investors worldwide, leveraging the fintech expertise of both companies.

Castle Hall opens an office within Abu Dhabi Global Market (ADGM), the international financial centre in Abu Dhabi, UAE. With this expansion, Castle Hall further broadens its global presence.

Castle Hall announces a comprehensive rebranding, marking the next stage of the company’s expansion. As “Castle Hall: The Due Diligence Company”, the firm’s updated identity highlights that due diligence is no longer limited solely to alternative investments. Due diligence is part of the governance, risk and compliance framework adopted by investment boards and trustees applicable to all external managers across all asset classes.

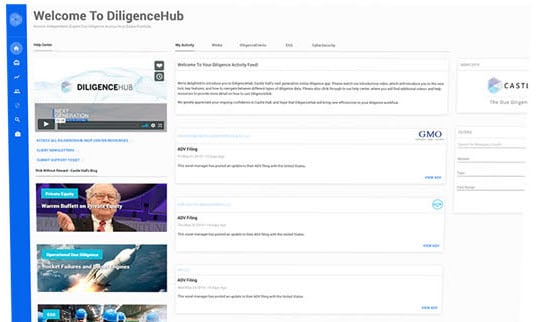

Castle Hall launched the next generation of its online diligence app. DiligenceHub introduces a new user interface and, behind the scenes, new technologies which allow for an impressive increase in app performance.

Castle Hall launches ESGDiligence, a suite of services to assess the ESG capacities of an investment manager at the firm and strategy-level. Castle Hall believes that, as the industry is moving towards greater integration of sustainability issues, the scope of due diligence should not be limited to operational and risk functions to ensure alignment with investment boards' and trustees' mandates, regardless of asset classes.

Montreal

1080 Côte du Beaver Hall, Suite 904

Montreal, QC

Canada, H2Z 1S8

+1-450-465-8880

Halifax

84 Chain Lake Drive, Suite 501

Halifax, NS

Canada, B3S 1A2

+1-902-429-8880

Manila

Ground Floor, Three E-com Center

Mall of Asia Complex

Pasay City, Metro Manila

Philippines 1300

Sydney

Level 36 Governor Phillip Tower

1 Farrer Place Sydney 2000

Australia

+61 (2) 8823 3370

Abu Dhabi

Floor No.15 Al Sarab Tower,

Adgm Square,

Al Maryah Island, Abu Dhabi, UAE

Tel: +971 (2) 694 8510

Copyright © 2021 Entreprise Castle Hall Alternatives, Inc. All Rights Reserved.

Terms of Service and Privacy Policy